This study examines a unique policy innovation in which a municipal government uses a lottery to award tax holidays to eligible taxpayers who are current on their payments of municipal taxes. The project is funded by the Abdul Latif Jameel Poverty Action Lab (J-PAL) Political Economy and Governance Program’s Governance Initiative (GI), which was founded to carry out randomized impact evaluations of programs designed to improve participation in the political and policy process, and reduce leakages in public programs.

See a full description of the project here.

Read the working paper here: Is Paying Taxes Habit Forming? Experimental Evidence from Uruguay

Researchers: Thad Dunning, Fernando Rosenblatt, Rafael Piñeiro, Felipe Monestier, and Guadalupe Tuñón

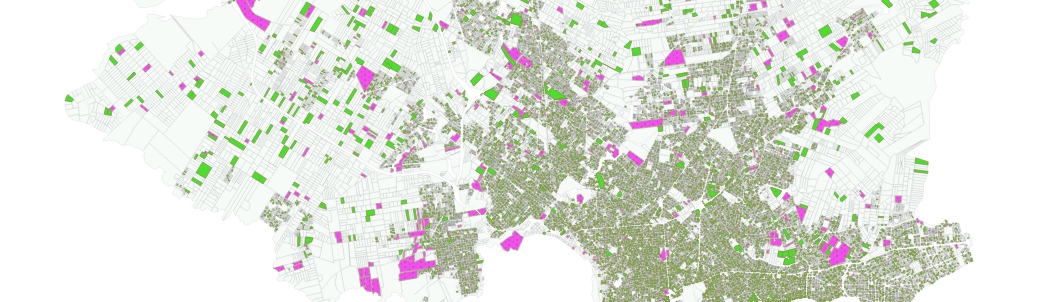

Location: Montevideo, Uruguay (Latin America and the Caribbean)

Timeline: February 2014 – February 2016